Building a Strong Foundation for the Future:

In today’s fast-paced and ever-changing world, financial literacy for kids is more important than ever. As children grow up surrounded by advertisements, digital transactions, and easy access to credit, understanding the basics of money management becomes essential. Financial literacy for kids is not just about learning to count coins or save pocket money; it’s about equipping children with the knowledge, skills, and confidence to make informed financial decisions throughout their lives.

Why Financial Literacy for Kids Matters:

Financial literacy for children lays the groundwork for responsible money management in adulthood. When children learn about earning, saving, spending, and investing from a young age, they develop healthy financial habits that can last a lifetime. Early exposure to financial concepts helps kids understand the value of money, the importance of budgeting, and the consequences of poor financial choices.

Studies consistently show that adults who received financial education as children are more likely to save regularly, avoid debt, and invest wisely. By prioritizing financial literacy for kids, parents and educators can help close the knowledge gap that often leads to financial stress later in life.

Key Concepts in Financial Literacy for Kids:

Financial literacy for kids covers a range of topics, each tailored to a child’s age and stage of development. Some of the most important concepts include:

1. Earning Money

Children should understand that money is earned through work. Whether it’s completing chores at home, helping neighbors, or running a lemonade stand, earning money teaches kids the value of effort and responsibility.

2. Saving and Budgeting

One of the core principles of financial literacy for kids is learning to save. Setting aside a portion of their allowance or gift money helps children develop patience and delayed gratification. Introducing simple budgeting techniques, like dividing money into “spend,” “save,” and “give” jars, can make the concept tangible and fun.

3. Spending Wisely

Kids need to learn the difference between needs and wants. Financial literacy for kids involves making choices about how to spend limited resources, understanding that buying one thing may mean giving up another.

4. Understanding Credit and Debt

While credit cards and loans may seem like adult topics, it’s never too early to introduce the basics. Explaining that borrowing money means paying it back-with interest-can help kids avoid common pitfalls in the future.

5. Investing and Growing Money

Older children and teens can benefit from learning about investing. Simple explanations of how money can grow through interest or stocks can spark curiosity and encourage long-term planning.

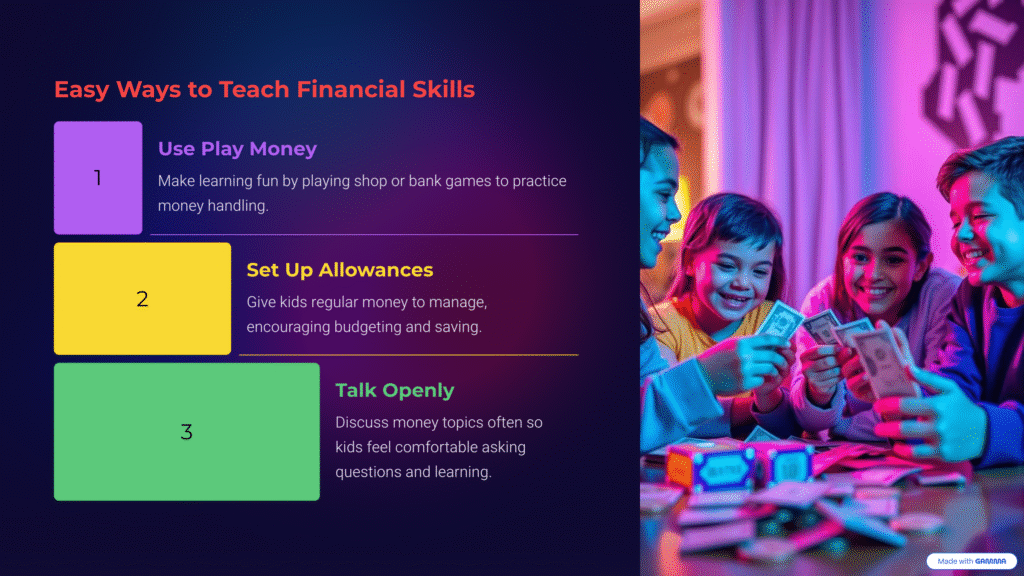

How to Teach Financial Literacy for Kids:

Teaching financial literacy for children doesn’t have to be complicated. Here are some practical strategies for parents and educators:

- Start Early

The earlier children are exposed to financial concepts, the better. Even preschoolers can grasp the idea of exchanging money for goods or saving coins in a piggy bank.

- Use Real-Life Examples

Everyday activities provide opportunities to teach financial literacy for kids. Shopping trips, family budgeting discussions, and planning for vacations can all become teachable moments.

- Make Learning Fun

Games and activities can make financial literacy for kids engaging and memorable. Board games like Monopoly or The Game of Life, as well as online simulations, teach money management in a playful way.

- Set a Good Example

Children learn by watching adults. Demonstrating responsible spending, saving, and charitable giving reinforces the lessons of financial literacy for kids.

- Encourage Questions

Kids are naturally curious. Encourage them to ask questions about money and involve them in age-appropriate financial decisions.

- Tools and Resources for Financial Literacy for Kids

Numerous tools and resources are available to support financial literacy for future adults. Many banks offer kid-friendly savings accounts, while educational websites and apps provide interactive lessons on money management. Books, videos, and classroom programs can also reinforce key concepts.

Some popular resources include:

- Piggy banks and savings jars: Simple tools for teaching saving and goal-setting.

- Allowance charts: Help track earnings, spending, and savings.

- Financial literacy apps: Interactive games and lessons tailored to different age groups . (Ex: Like courses available at www.elearnfinance.com )

- Children’s books: Stories that introduce money concepts in a relatable way. RBI has taken initiative for Financial Education for children.

The Role of Schools in Financial Literacy for Kids:

While parents play a vital role, schools are equally important in promoting financial literacy for children. Integrating personal finance education into the curriculum ensures that all children, regardless of background, have access to essential knowledge.

Many schools now offer age-appropriate lessons on budgeting, saving, and investing. Classroom activities, such as running a mock store or participating in a stock market simulation, provide hands-on experience and reinforce the importance of financial literacy for kids.

Overcoming Challenges in Teaching Financial Literacy for Kids:

Despite its importance, teaching financial literacy for kids can be challenging. Some parents may feel uncomfortable discussing money, while others may lack the knowledge themselves. Cultural attitudes toward money and socioeconomic factors can also influence how children learn about finances.

To overcome these challenges, it’s important to:

- Promote open communication: Normalize conversations about money at home and in the classroom.

- Seek out resources: Take advantage of books, online tools, and community programs.

- Collaborate: Encourage partnerships between parents, schools, and community organizations to support financial literacy for kids.

The Long-Term Benefits of Financial Literacy for Kids:

Investing in financial literacy for children pays lifelong dividends. Children who understand money management are better equipped to handle financial challenges, avoid debt, and build wealth. They are more likely to set and achieve financial goals, contribute to their communities, and enjoy greater financial security.

Moreover, financial literacy for future adults fosters critical thinking, decision-making, and problem-solving skills that extend beyond money matters. It empowers children to take control of their futures and make choices that align with their values and aspirations.

Conclusion:

Financial literacy for responsible and sensible citizens is a vital life skill that should be nurtured from an early age. By teaching children about earning, saving, spending, and investing, we give them the tools they need to navigate the complexities of the modern financial world. Whether at home, in school, or through community programs, prioritizing financial literacy for kids is an investment in their future success and well-being. With the right guidance and support, today’s children can grow into financially savvy adults who make smart, informed decisions for themselves and their families.